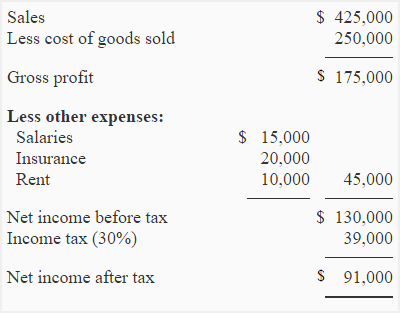

Read the following which is taken from an income statement.Rs.Opening stock 50,000 Sales 1,60,000 Freight incurred 10,000 Sales retunrs 10,000 Gross profit on sales 60,000 Net loss for the year 10,000 Purchases

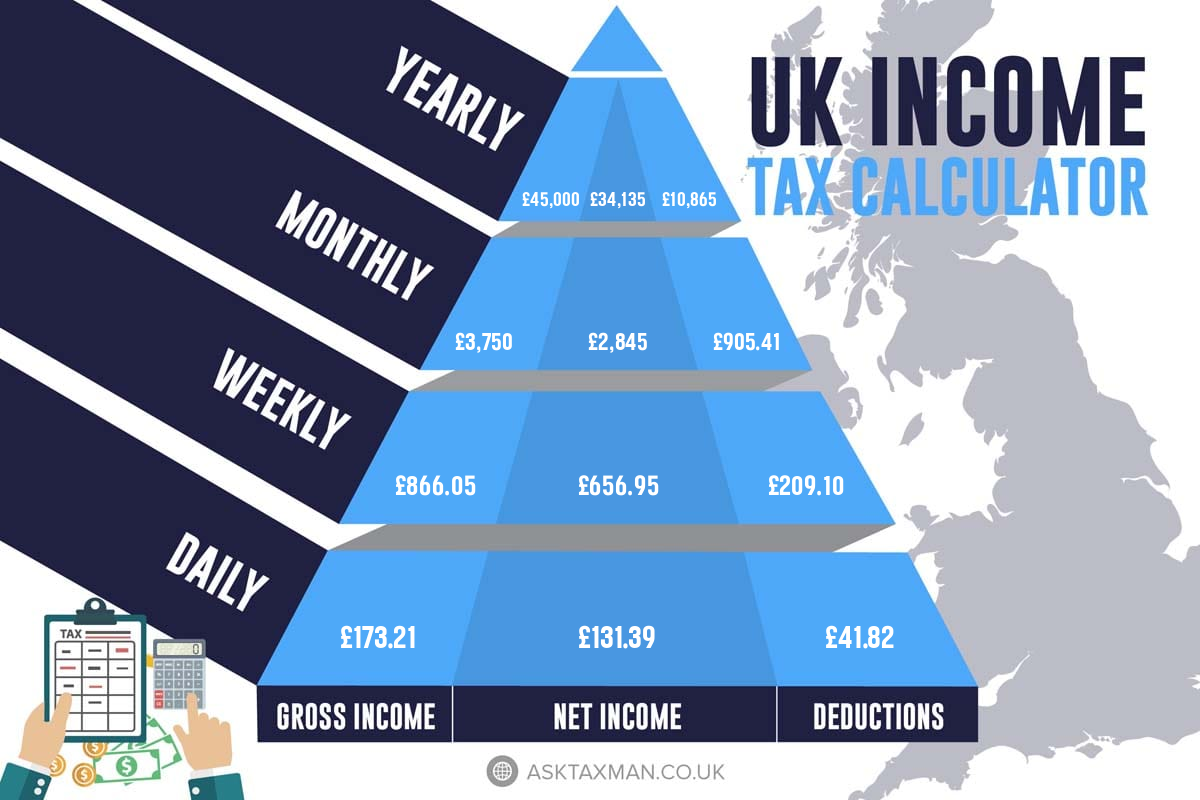

CBO Data Shows that Income After Taxes and Transfers has Increased While Market Income has Remained Nearly Unchanged for the Middle Class | Tax Foundation