Potential Carbon Tax Imposition in Boosting Low-Carbon Green Economic Activity by The International Journal of Business Management and Technology, ISSN: 2581-3889 - Issuu

Supply control vs. demand control: why is resource tax more effective than carbon tax in reducing emissions? | Humanities and Social Sciences Communications

Health benefits from the reduction of PM2.5 concentrations under carbon tax and emission trading scheme: a case study in China | SpringerLink

How a carbon tax will affect an emission-intensive economy: A case study of the Province of Saskatchewan, Canada - ScienceDirect

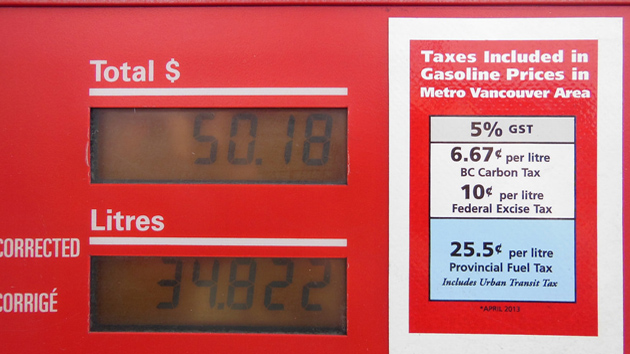

British Columbia Enacted the Most Significant Carbon Tax in the Western Hemisphere. What Happened Next Is It Worked. – Mother Jones

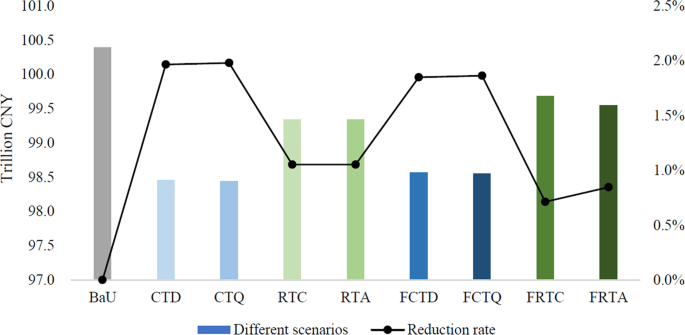

Buildings | Free Full-Text | Assessing the Impacts of Carbon Tax and Improved Energy Efficiency on the Construction Industry: Based on CGE Model

Max Roser on Twitter: "Does a carbon tax reduce CO2 emissions? In this AEJ paper Julius Andersson shows for the Swedish transport sector how large the effect is. After the implementation of