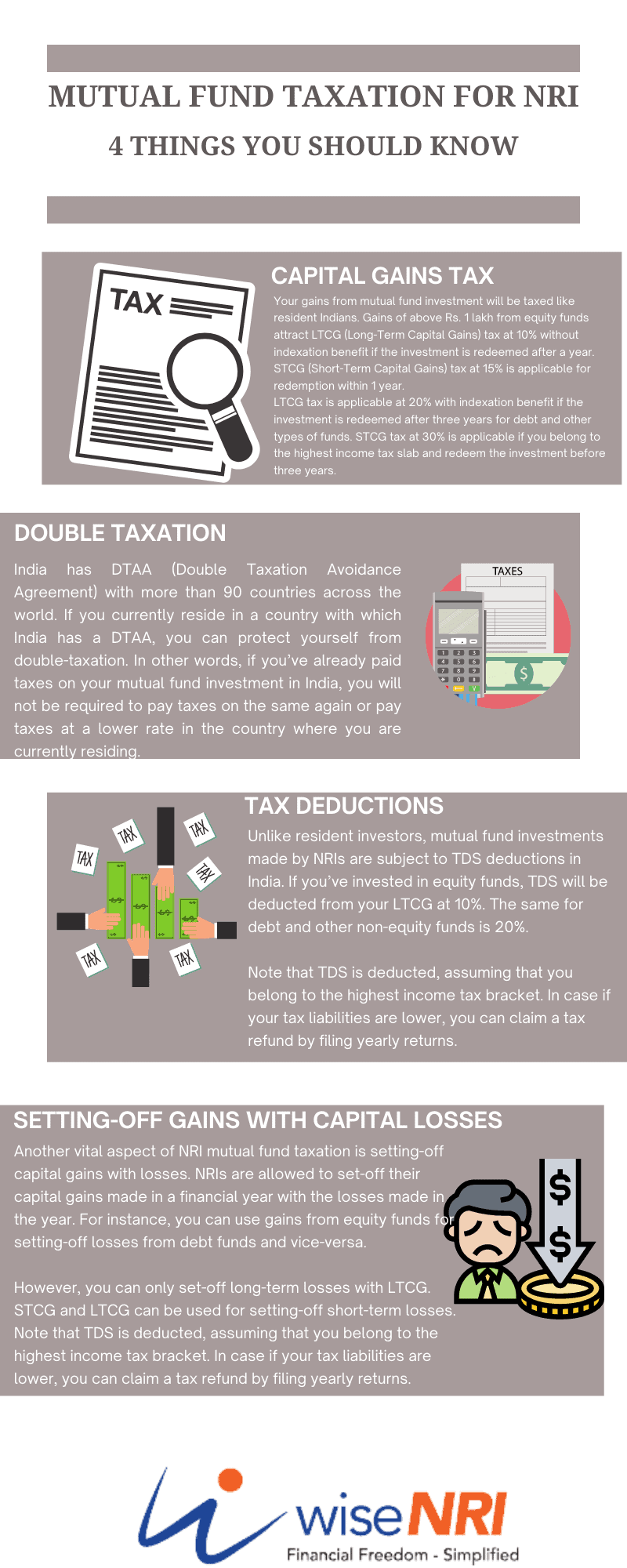

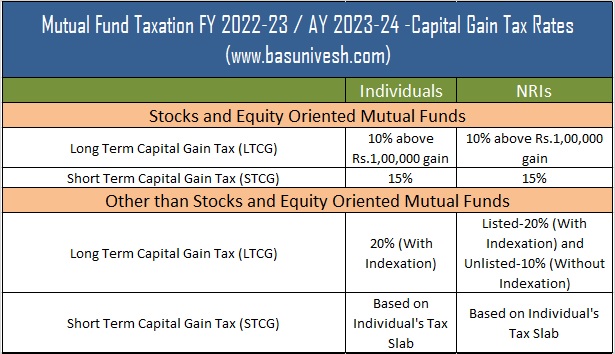

Mutual Funds Capital Gains Taxation Rules FY 2018-19 (AY 2019-20) | Capital Gains Tax Rates Chart for NRIs. | Mutuals funds, Capital gain, Fund

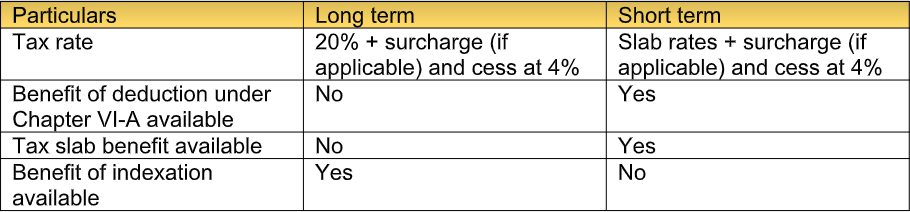

Tax Investment: A quick guide for NRIs while filing tax for the investment made in India - The Economic Times

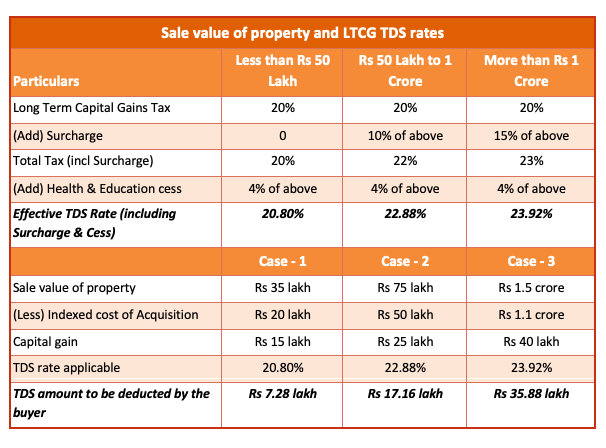

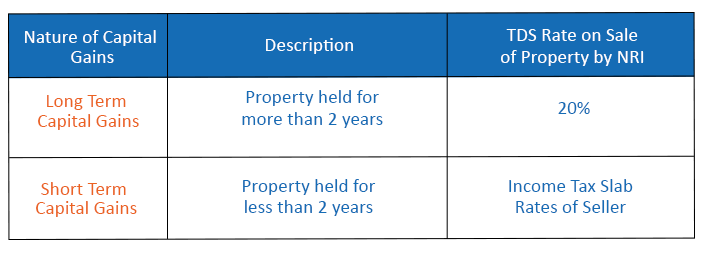

Explained: Taxation on the sale of immovable property in India by non-residents - The Economic Times

![TDS on Sale of Property by NRI in India [New Rates for 2023] - SBNRI TDS on Sale of Property by NRI in India [New Rates for 2023] - SBNRI](https://sbnri.com/blog/wp-content/uploads/2023/05/Exemption-on-Capital-Gain-Tax.png)