Bhuvan on Twitter: "What a googly. Debt funds, gold, international funds, Fund of funds will no longer be eligible for long term capital gains (LTCG). On one hand, I hope this doesn't

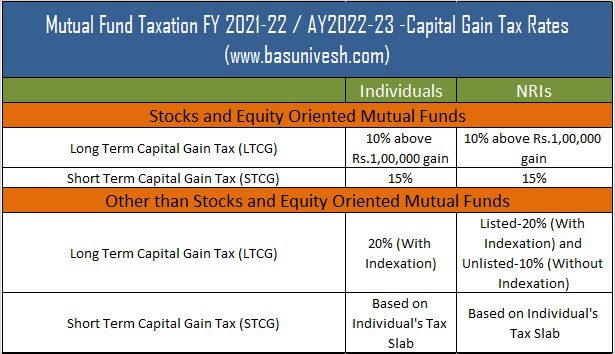

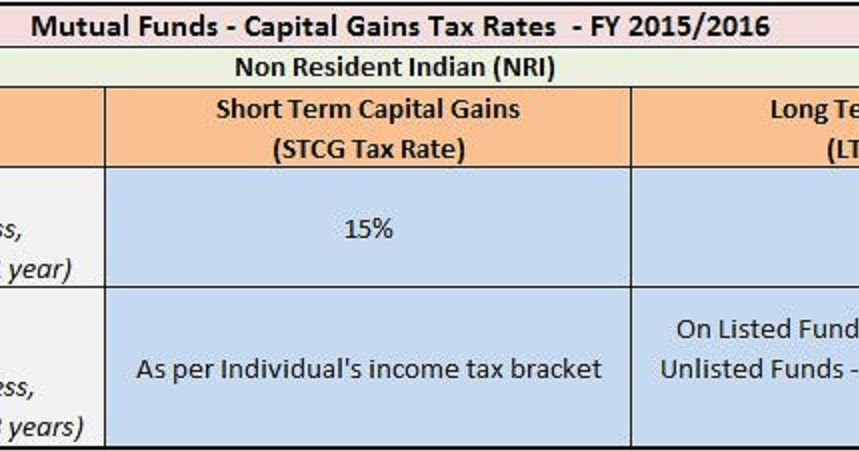

Do You Know How Tax On Mutual Funds Impact Your Returns ☆ FY 2021-22? ☆ ApnaPlan.com – Personal Finance Investment Ideas

Finance Bill 2023 passed in Lok Sabha: Capital gain from debt mutual funds to be taxed as per income tax slab - BusinessToday

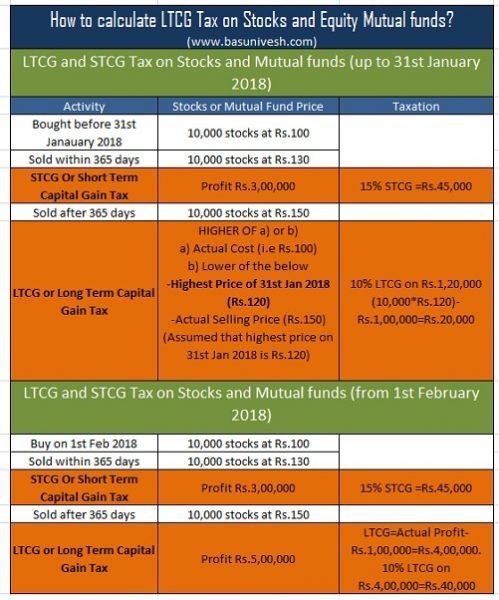

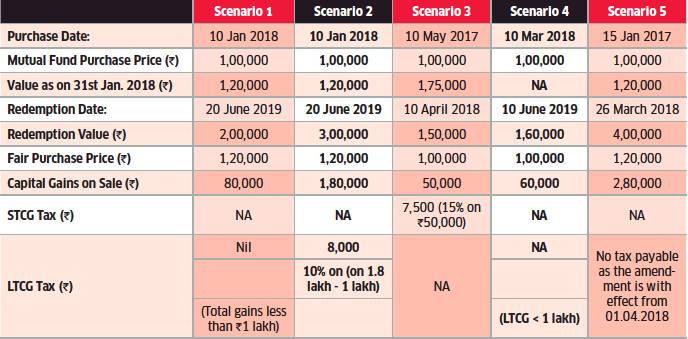

Mutual Funds and Shares New Rule | 10% LTCG Tax on Stocks/Equity Mutual Funds | Budget 2018 - YouTube

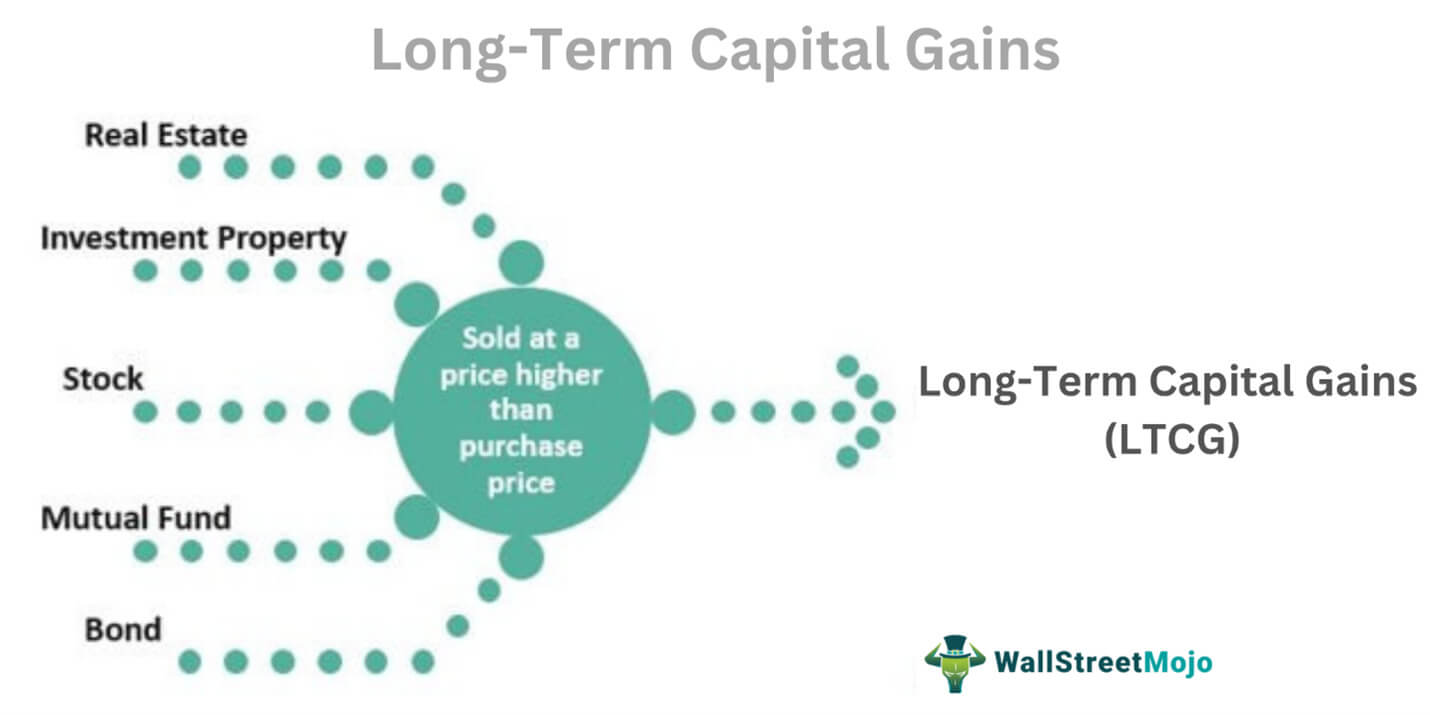

Difference Between Short and Long Term Capital Gains - Compare & Apply Loans & Credit Cards in India- Paisabazaar.com

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)