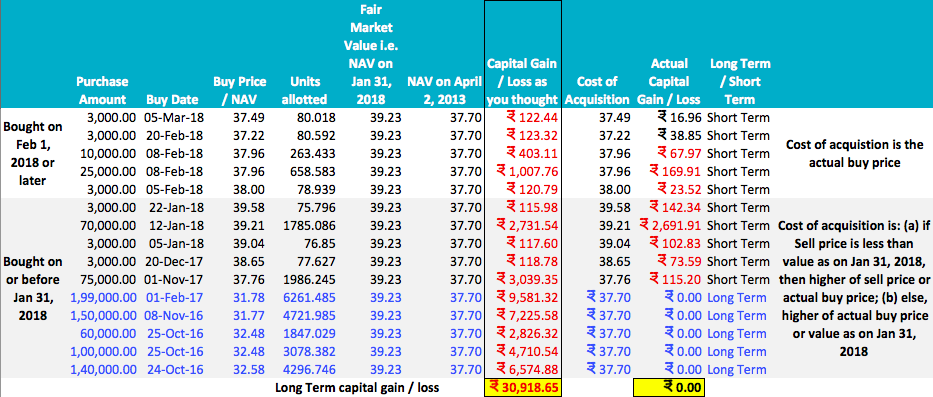

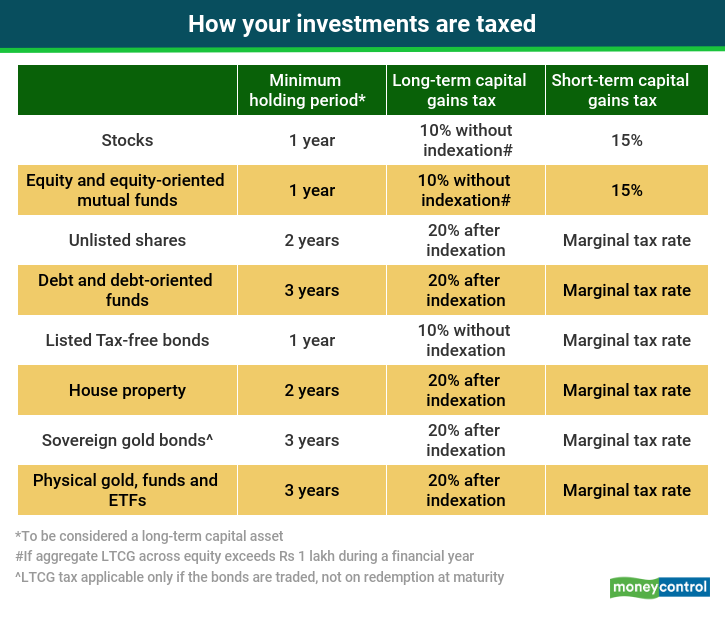

توییتر \ ValueMulticaps در توییتر: «#Tax on Selling #Stocks Visit: https://t.co/hYzHItfY4L Telegram: https://t.co/vBNE3J8T39 #ValueMulticaps #stockmarkets #stocks #intradaytrading #INTRADAY #taxes #whatsappforward https://t.co/9Mc31hr3zj»

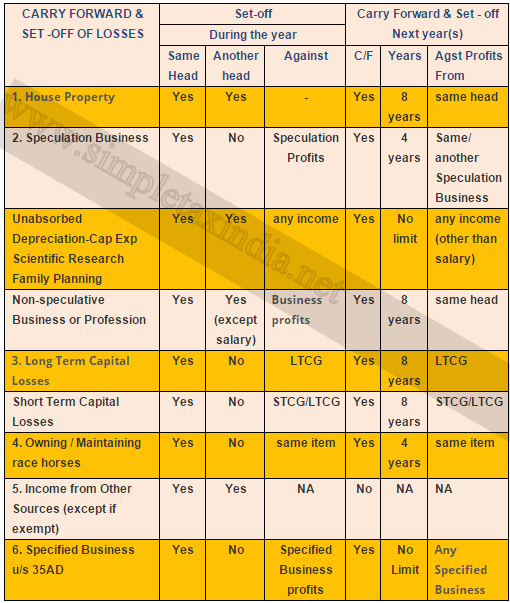

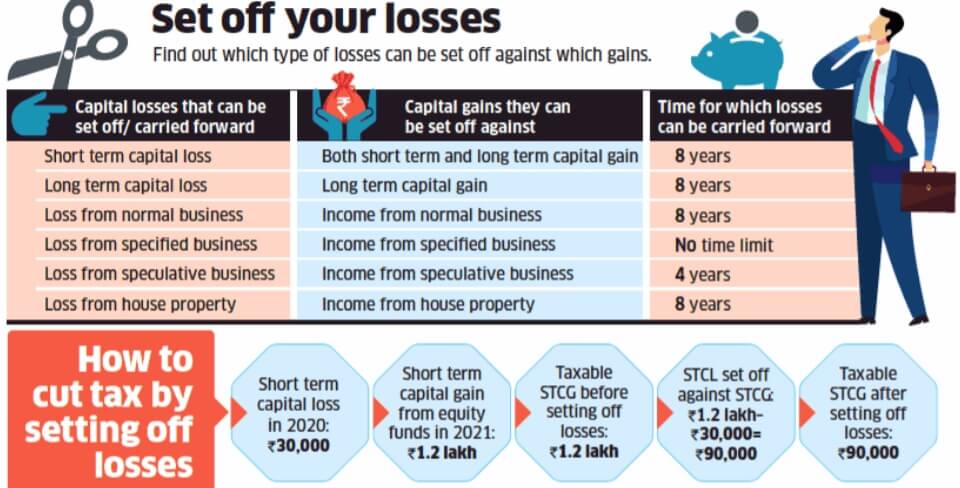

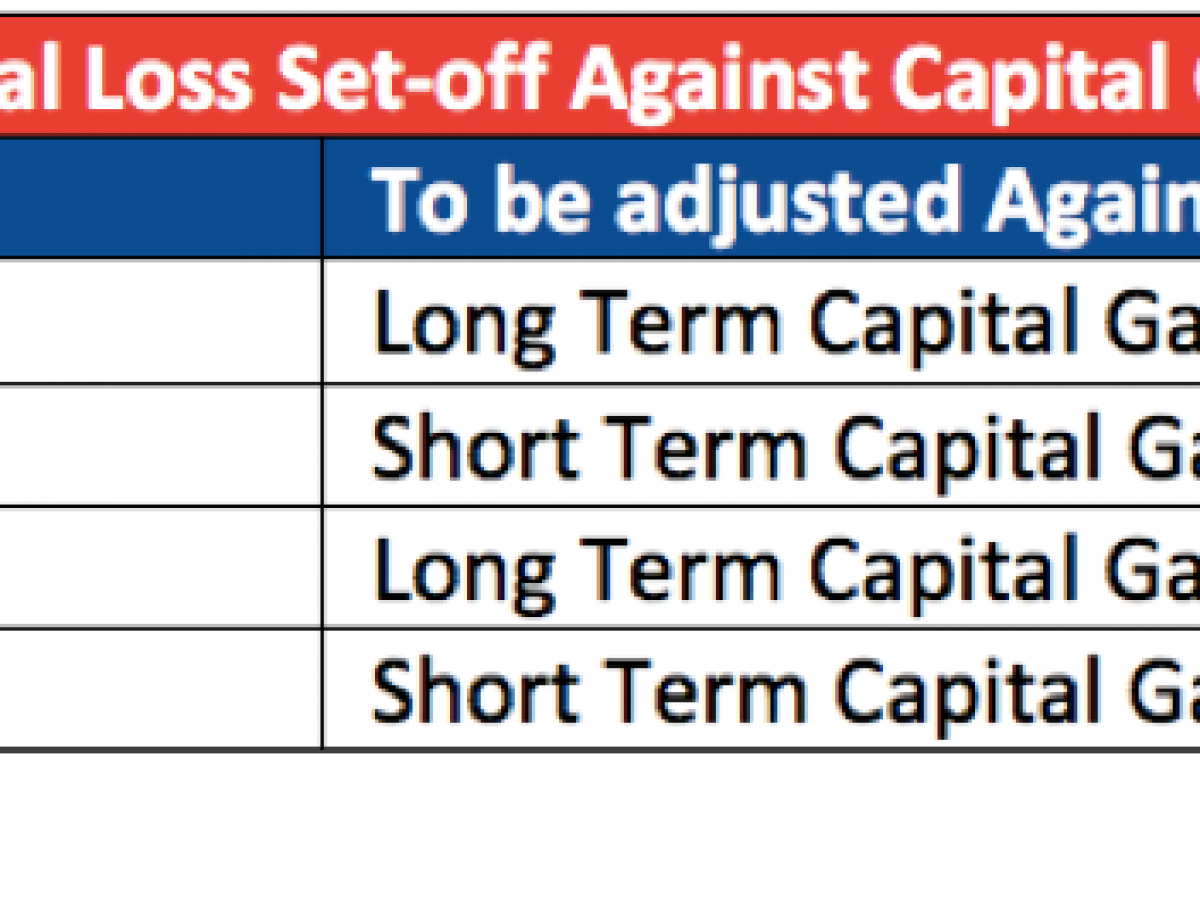

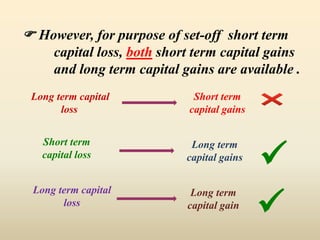

Plantaxation - Did You Know? Short term capital loss of equity shares can be set off against short term or long term capital gain from capital asset. If the loss is not

What to do if you suffer loss in business or investment: How to set off losses to cut tax, manage finances - The Economic Times

B/F business loss can be set off against short-term capital gains arising from sale of business assets: ITAT

Regarding Short term gains and losses - Taxation - Trading Q&A by Zerodha - All your queries on trading and markets answered

:max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg)