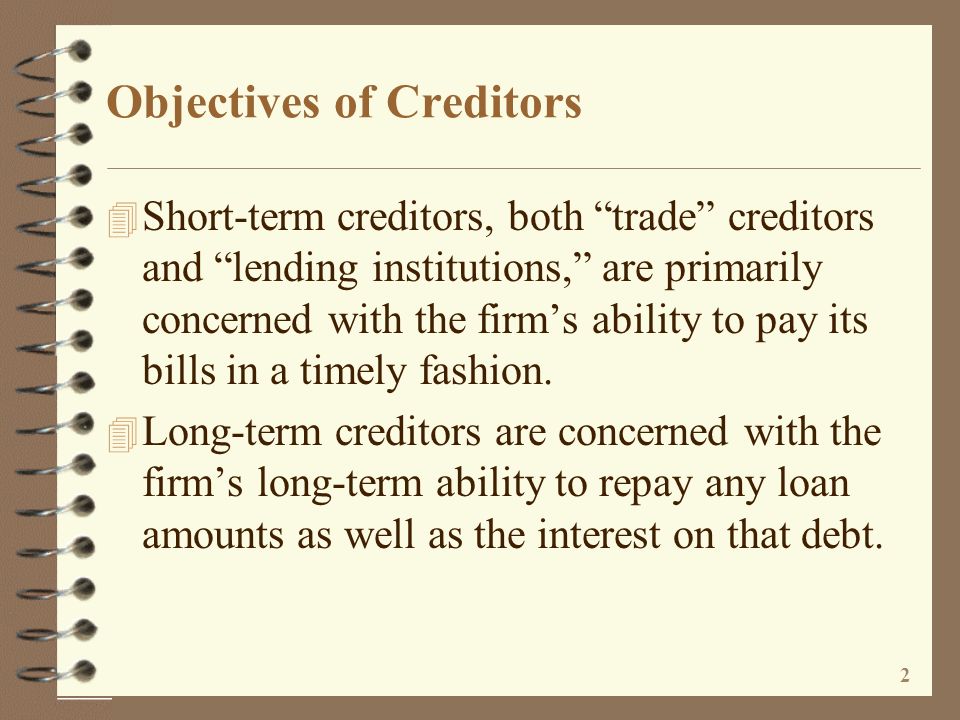

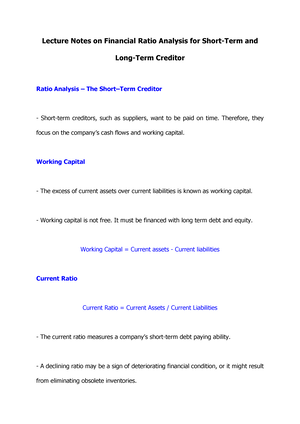

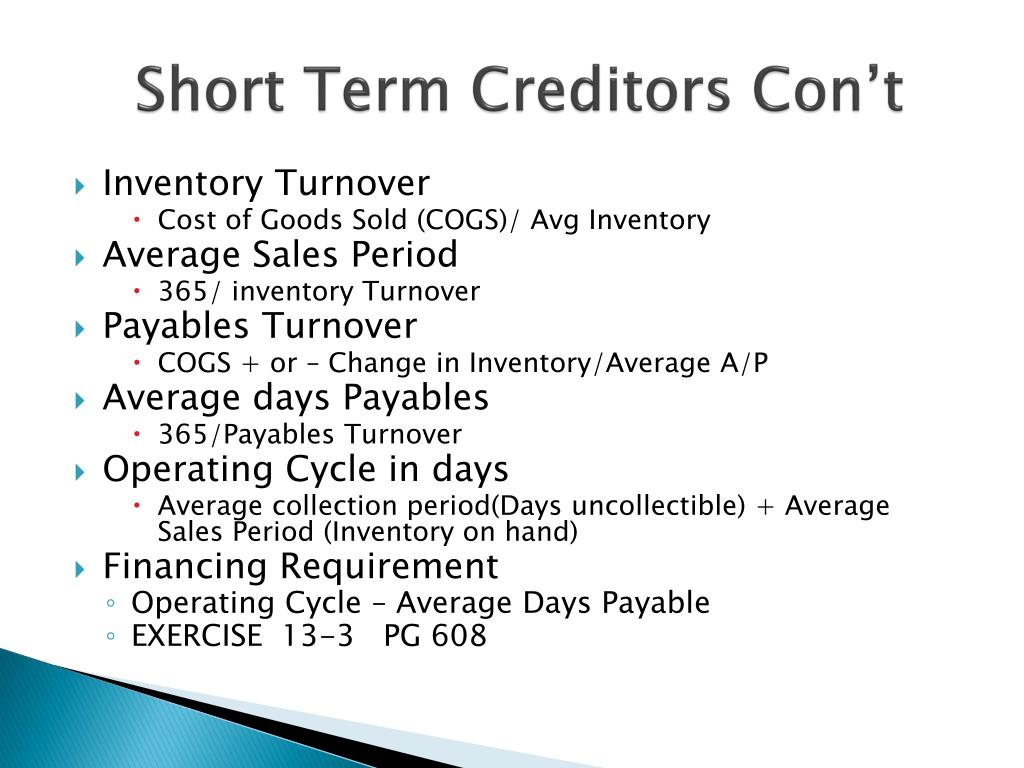

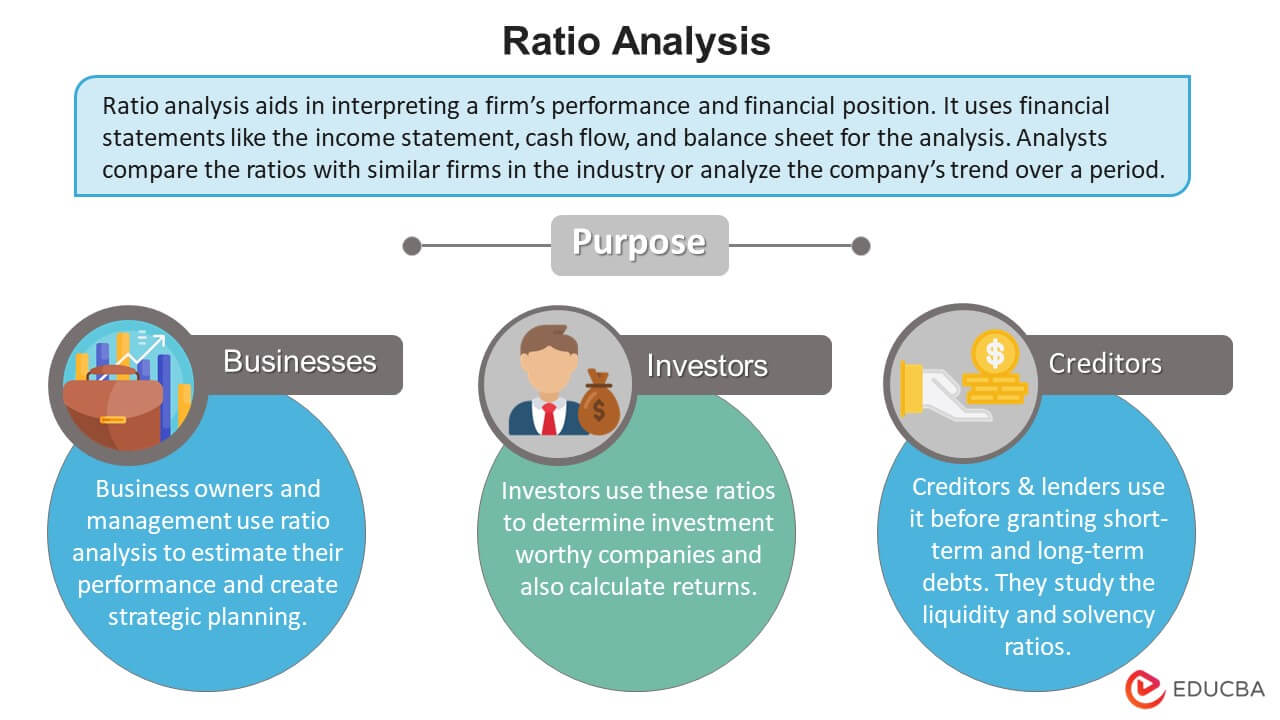

Ratio Analysis Ratio analysis is a particular type of financial statement analysis where the relationship between two or more items from the financial. - ppt video online download

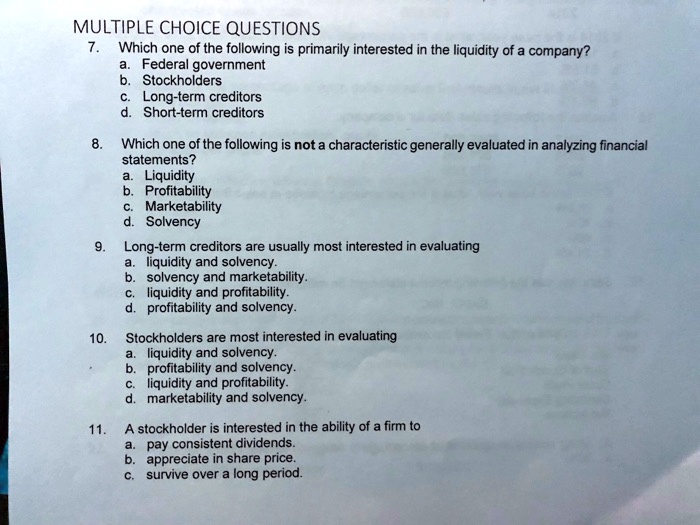

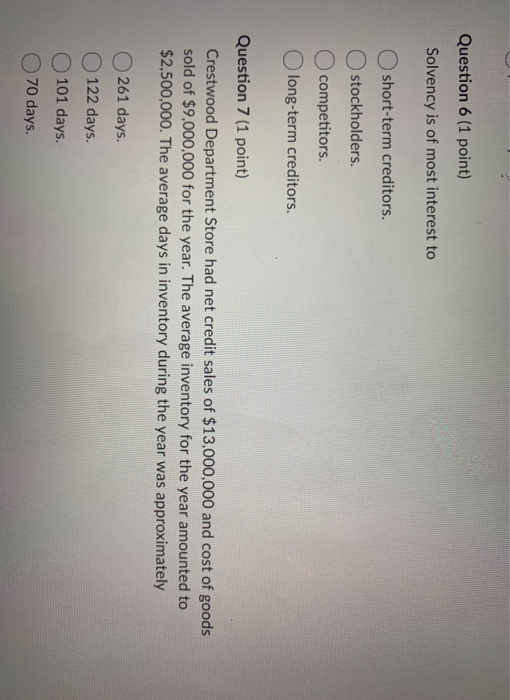

SOLVED: MULTIPLE CHOICE QUESTIONS 7.Which one of the following is primarily interested in the liquidity of a company a. Federal government b.Stockholders c.Long-term creditors d.Short-term creditors 8. Which one of the following

Q1. Evaluate the financial performance (from Equity shareholders perspective) and short-term & - Brainly.in

:max_bytes(150000):strip_icc()/preferred-creditor-Final-3521f5da61044636ba048cacea1db2ef.png)

:max_bytes(150000):strip_icc()/Short-term-debt-4189071-primary-FINAL-c1b4a4cea56245268c8b0d16f7aa7e22.png)